Why Climate Finance Needs Generative AI

The financial sector plays a pivotal role in addressing climate change. From allocating capital to green projects to managing climate-related risks in portfolios, institutions are expected to act with both speed and precision.

However, traditional methods often fall short:

- ESG data is fragmented, often siloed in reports, PDFs, or third-party datasets.

- Climate risk modelling is resource-intensive, requiring interdisciplinary expertise.

- ESG reporting processes are slow and repetitive, tying up valuable staff time.

Generative AI offers a way to tackle all three challenges simultaneously.

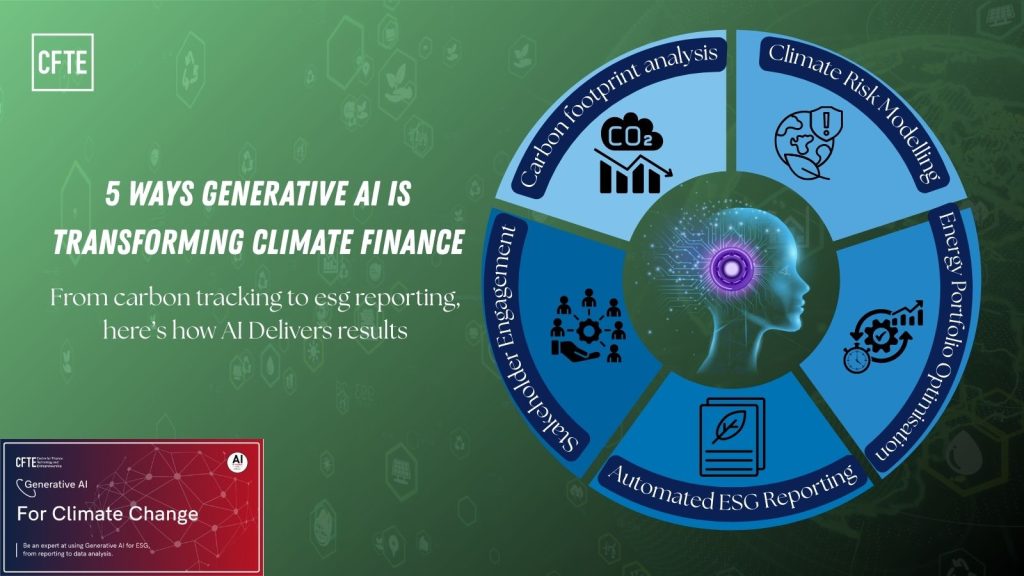

Five High-Impact Use Cases

1. Carbon Footprint Analysis

Generative AI can process vast supply chain data, normalise it across formats, and generate accurate carbon footprint estimates.

Example: A global bank used AI to analyse Scope 3 emissions across its loan portfolio, identifying high-emission clients and targeting them with green financing incentives.

2. Climate Risk Modelling

By combining satellite imagery, historical climate patterns, and economic indicators, GenAI can simulate how different climate scenarios impact asset values.

Example: Asset managers in Europe have used AI-powered climate stress testing to prepare for mandatory TCFD reporting, spotting vulnerabilities years before regulatory deadlines.

3. Energy Portfolio Optimisation

Generative AI can recommend divestment from carbon-intensive assets and highlight greener alternatives, factoring in both sustainability scores and financial performance.

4. Enhanced ESG Reporting

Instead of manually crafting annual ESG reports, institutions can use AI to generate jurisdiction-specific documents that meet compliance needs while engaging stakeholders with clear, data-backed narratives.

5. Stakeholder Engagement at Scale

Generative AI enables tailored messaging for different audiences — regulators, investors, or internal teams — all drawn from the same verified ESG dataset.

Proof in Action

The Bank for International Settlements (BIS) applied Generative AI to ESG data extraction across 187 banks worldwide, automating a task that would have taken months of manual review (Thomson Reuters).

The Skills Gap Challenge

While these applications are powerful, they require leaders who can:

- Select the right AI tools for ESG contexts.

- Ensure compliance with AI ethics and sustainability principles.

- Translate AI outputs into actionable ESG strategies.

Closing the Gap with Targeted Learning

The Generative AI for Climate Change in Financial Services course teaches you how to implement all five use cases in your own institution — from tool selection to governance frameworks.

💡 Special Offer:

Get 20% off this week only with code ClimateChangeLaunched2025