There was a time when AI was seen as the domain of data scientists and innovation teams.

That time is over.

In 2025, AI is embedded into strategy, compliance, operations, and client delivery — and professionals in leadership positions are expected to understand it.

AI isn’t just a technical skill anymore. It’s a leadership one.

Leaders Are Now Expected to Understand AI

According to LinkedIn’s AI at Work 2025 report, 81% of L&D professionals believe leaders must upskill in AI to remain effective.

PwC’s Global AI Jobs Barometer echoes this:

The fastest-growing demand is for managers, directors, and senior professionals who can confidently integrate AI into their teams and decisions.

This shift is especially relevant in financial services, where:

- Compliance is tightening under regulations like the EU AI Act

- Operational teams are adopting AI workflows at scale

- Clients expect trusted guidance — not vague promises

Being AI-blind is no longer acceptable in leadership.

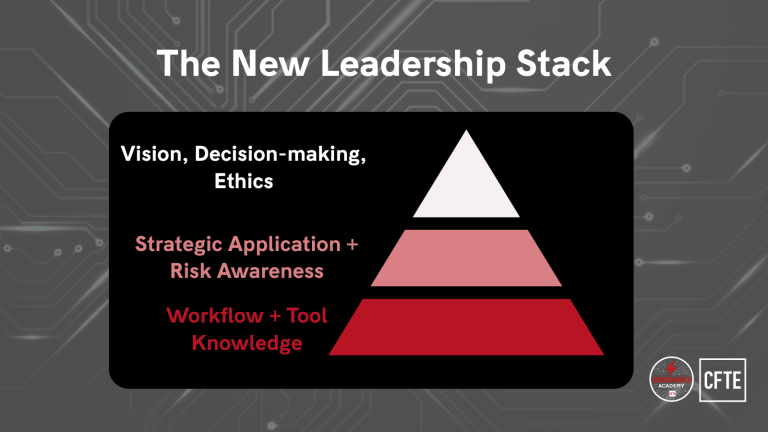

What Does AI Fluency Mean for Leaders?

AI fluency doesn’t mean becoming technical. It means:

- Understanding what AI can and can’t do

- Using AI to improve workflows, productivity, and insight

- Making responsible, compliant decisions about tool use

- Guiding teams through change with confidence

AI fluency is the new digital fluency.

If you can’t speak the language, you can’t lead the conversation.

The Executive AI Certificate: Designed for Leadership

The Executive AI Certificate was built specifically to help senior professionals develop true fluency — without becoming technical.

In four weeks, leaders:

- Benchmark their AI capability with the AIQ

- Learn applied use cases in finance (risk, strategy, compliance, operations)

- Understand frameworks for ethical and responsible use

- Build a portfolio of outputs they can use with teams or clients

- Earn a certification recognised by global institutions

This is structured learning for people who need to act — not just explore.