In February 2011, Stephen Elop, newly installed as CEO of Nokia, sent a memo to his executive team that would become a modern parable in leadership and strategy. He opened with a stark, unforgettable image:

“There is a pertinent story about a man who was working on an oil platform in the North Sea. One night, after a loud explosion, his entire platform is on fire. Surrounded by flames, he edges toward the rim and looks down into freezing, dark waters. The fire approaches. He has moments to decide: stay and be consumed, or plunge 30 metres into the icy depths. He jumps. We too, are standing on a ‘burning platform,’ and we must decide how we are going to change our behaviour.”

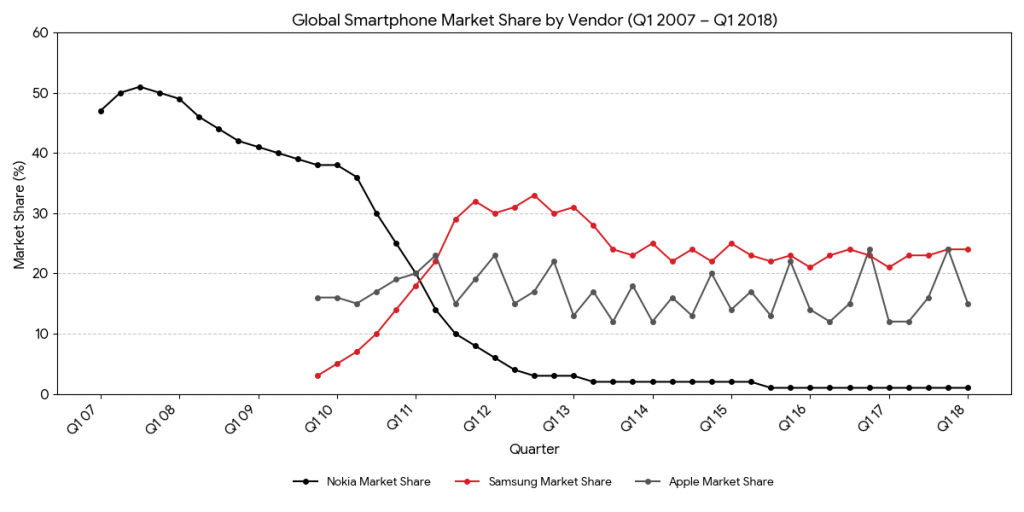

Elop’s metaphor was not a flourish but a deliberate shock. He was sending a message. Nokia’s world had shifted faster than its systems could adapt. Its assumptions, processes, culture — all were under threat. Around it new competitors and ecosystems were rising and rethinking the terrain of mobile and digital value.

That memo demanded more than reflection. It demanded decision. Elop was saying the platform beneath you is ablaze. You must leap or be left behind.

The Fire Beneath Us Now: The AI Imperative

Fast forward to today and the terrain has changed. The platform many organisations stand on is still burning, but now it is fuelled not by hardware disruption or shifting app ecosystems but by artificial intelligence, data, speed and model infrastructure.

The pressures are many and urgent:

- Rivals are weaving AI into the very fabric of customer journeys, operations, risk systems, not as pilots but as foundational elements.

- Legacy systems, data siloes and technical debt slow down responsiveness, making experimentation costly and fragile.

- Top talent is gravitating to AI native firms, drawn by autonomy, mission and modern tools.

- Ethical, regulatory, trust and transparency challenges have moved from abstract concerns to immediate risks.

- Many organisations are trapped in perpetual experimentation, pilots that never scale and insights that never embed.

Make no mistake: the risk is not that AI will catch up to us. It has already done so. The question is whether we act now to redefine our foundations before the burn becomes irreversible.

Jumping with Intention

The story of Nokia’s burning platform is instructive. That leap was radical, urgent and bold. But it was also messy, faltering and uneven. A powerful metaphor yes, but not a guarantee of success.

What matters is not the leap itself but how you land. To make that leap with intention leaders must reimagine strategy, structure, governance, culture and execution in harmony.

Here is one possible path forward:

- Diagnose readiness

Assess where you stand in terms of data, engineering, governance and culture. Use rigorous maturity frameworks. Identify real constraints and ignition points - Launch fast pilots under disciplined architecture. Choose high impact use cases aligned with strategy. Build in modular, interoperable fashion rather than creating fragility.

- Build the AI platform and operational backbone

Move beyond proof of concept. Invest in pipelines, model operations, monitoring, deployment, retraining and feedback loops so AI becomes part of the core. - Cultivate governance, ethics and human capacity

Embed structures for oversight, audit, bias control and transparency. Launch training programmes and shift mindsets. Empower experimentation within safe guardrails.

- Diagnose readiness

Through every phase, leaders must make decisions, accept ambiguity and iterate rather than wait for perfect clarity.

To support leaders in navigating this journey CFTE offers AI for Senior Leaders in Finance, a programme tailored to executives who must convert urgency into strategy and action. The workshop equips decision makers with frameworks, real examples and tools to lead AI transformation responsibly and effectively, focusing on leadership, governance and strategic design rather than coding.

We are standing on a burning AI platform. The fire is real. The water is cold. The leap is ours to make and how we land will define our future.