In a timely session on Generative AI in Finance and Climate, regulatory risk and transformation leader Amit Agrawal explored how AI can accelerate progress on sustainability – not just as a technical tool, but as a catalyst for new governance models, business opportunities and careers.

With over 15 years of experience across financial services, fintech and consulting, Amit has led large-scale remediation programmes and digital transformations, helping organisations shift from viewing compliance as a cost to treating it as strategic value. In this webinar, he applied that lens to one of the defining challenges of our time: climate change and the transition to a green economy.

Why Investing in Sustainability Makes Business Sense

Amit began by reframing sustainability as a return-generating investment, not a side cost. Citing data from the Carbon Disclosure Project (CDP) and similar analyses, he highlighted that companies investing in sustainability often see:

- Significant financial upside relative to the cost of climate initiatives

- Tangible reductions in risk exposure across operations and supply chains

- Benefits across multiple sectors – from energy and manufacturing to agriculture and services

In practical terms, sustainability spending can translate into higher resilience, better market access, and improved long-term profitability. Failing to invest, by contrast, comes with a mounting price tag as climate risks materialise.

Climate Reality: Narrowing Windows and Rising Pressures

Amit then grounded the discussion in the current climate trajectory. The world has already crossed the 1.5°C threshold in recent measurements, and extreme weather events – heatwaves, floods, fires – are increasing in both frequency and intensity.

He connected this to:

- Geopolitical conflicts (e.g. wars and regional tensions) that divert attention and funding away from ESG priorities

- Policy fragmentation, particularly where some jurisdictions roll back or stall climate regulations while others move ahead

- The shrinking “window for change”, which means incremental action is no longer enough

All of this, he argued, makes innovation and technology indispensable if we want to have any realistic chance of achieving net-zero pathways.

The Evolving Regulatory and Disclosure Landscape

Amit walked participants through the fast-changing ecosystem of sustainability standards and reporting frameworks:

- IFRS sustainability standards, GRI, TCFD and others increasingly converging

- Local adaptations such as MAS guidelines, OSFI expectations in Canada and EU frameworks influencing market behaviour

- Emerging initiatives like TNFD (Taskforce on Nature-related Financial Disclosures), with hundreds of organisations managing trillions in assets beginning to adopt nature and climate-related risk reporting

The direction of travel is clear: disclosure is tightening, expectations are rising, and organisations that treat ESG as optional are likely to lose access to markets, capital and key trade corridors.

AI as Climate Accelerator: Use Cases and Opportunities

A central question of the session was whether AI is a climate risk multiplier or a climate accelerator. Amit’s answer: used responsibly, it can and must be a powerful accelerator.

He discussed how AI can:

- Optimise energy use and support grid balancing between renewable and non-renewable sources

- Improve emissions measurement and forecasting, including Scope 3 emissions

- Enable smarter supply chain and scenario modelling, helping firms adapt to climate disruptions

Concrete examples included:

- A BIS-linked project exploring AI-driven Scope 3 accounting, using data ingestion, modelling and optimisation to identify lower-emission pathways and report more accurately

- A Singapore-based initiative involving MAS and Smart Nation agencies, using smart meters and sensors to collect real-time energy data across buildings and sectors, enabling benchmarking, simulations and more informed policy and investment decisions

Across sectors – energy, manufacturing, agriculture, transport and finance – Amit showed that AI is already being applied to reduce emissions, cut waste and increase resilience.

Risks, Governance and Responsible AI Principles

Amit was clear that AI is not a silver bullet. It introduces new risks:

- Data quality and cyber risk

- Opacity and explainability challenges in complex models

- Bias and fairness issues, driven by skewed training data

- Environmental concerns about AI’s own energy usage, which must be weighed against the emissions reductions it can enable

He argued that successful climate AI solutions must be:

- Purpose-driven – targeted at clear sustainability outcomes (e.g. emissions reduction, resource efficiency, social impact)

- Responsibly governed – aligned with frameworks such as the EU AI Act and sectoral principles (e.g. MAS FEAT/FI principles)

- Human-informed – developed with input from climate scientists, ESG specialists, risk experts and domain practitioners

- Energy-conscious – designed to minimise unnecessary compute and maximise net environmental benefit

In short, climate tech must combine technology, ethics and purpose, not treat them as separate conversations.

Green Skills, Careers and the Intersection of AI and ESG

The latter part of the session focused on skills and career opportunities in the emerging green economy. Drawing on research from LinkedIn, BCG and others, Amit noted:

- Jobs requiring green skills are growing faster than the overall job market

- Demand for profiles combining data/AI, regulation, finance and sustainability knowledge is rising across sectors

- Roles may not always be labelled “ESG”, but appear under headings like decarbonisation, net-zero strategy, supply chain sustainability or climate risk

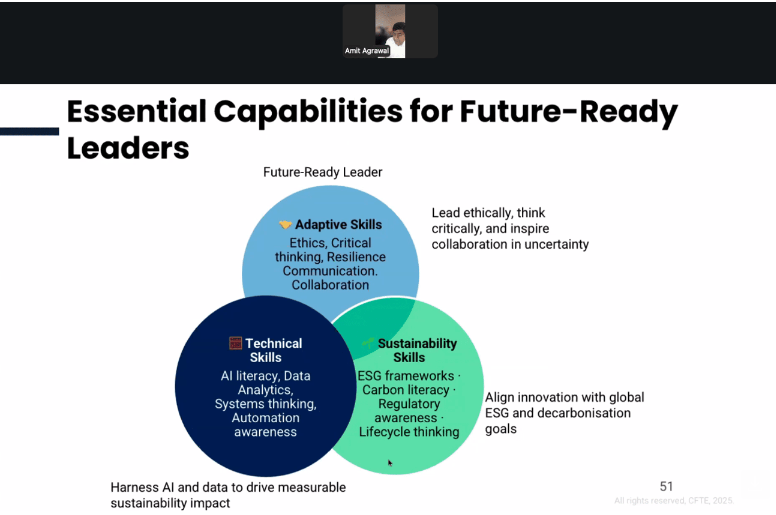

He emphasised that professionals should:

- Map their existing transferable skills (e.g. analytics, technology, stakeholder management, regulation, finance)

- Identify target gaps in ESG, climate science, sustainability frameworks or AI literacy

- Build capabilities at the intersection of green and digital – where climate and AI meet

Courses like “Generative AI for Climate Change in Finance” are designed to help practitioners understand both technical tools and governance frameworks, positioning them for roles in this fast-evolving space.

5 Key Learning Outcomes from the Webinar

1. Sustainability is a strategic investment, not a cost centre

Participants saw evidence that investing in climate and sustainability initiatives can generate significant financial and risk-adjusted returns, while inaction carries mounting costs.

2. Climate risk is real, accelerating and intertwined with geopolitics

From breaching 1.5°C to conflicts that distract from ESG agendas, the pressure on organisations to act quickly and intelligently has never been greater.

3. AI can act as a climate accelerator when used with purpose

AI can reduce emissions, optimise energy use, improve reporting and model complex climate scenarios, provided it is designed with clear sustainability goals.

4. Responsible AI requires governance, ethics and domain expertise

Data quality, bias, explainability and energy use must be actively managed. Climate AI solutions must integrate ethical frameworks and input from ESG and climate experts.

5. The most valuable careers sit at the intersection of green skills and AI

Future-ready professionals will blend knowledge of climate and sustainability with skills in data, regulation, finance and technology, creating new roles across industries.

As climate risks intensify and regulatory expectations catch up, AI is emerging as both a challenge and a powerful ally. Amit’s session made it clear that the organisations – and individuals – who will thrive are those who treat climate action as a strategic opportunity and embrace AI as a tool to accelerate it, not avoid it. By combining green skills with data, governance and technology, today’s professionals can help shape a financial system that is not only more efficient, but also more resilient, equitable and aligned with the realities of a warming world.