The latest Blockchain and Digital Assets session brought together global participants to explore one of the most transformative shifts now reshaping global trade: the tokenisation of trade finance assets. Led by Saloi Benbaha, Head of XDC Network Enterprise Alliance & Ventures and Global Women in AI Ambassador, the session unpacked how tokenisation, harmonised standards and cross-industry collaboration are redefining efficiency, transparency and trust across the trade ecosystem.

With a career spanning telecom, banking, blockchain and energy, and fresh from receiving the Policy Pioneer Award at the House of Lords, Saloi delivered a masterclass on what financial institutions must understand to stay competitive in a rapidly digitising world.

Tokenisation as a Catalyst in Trade Finance

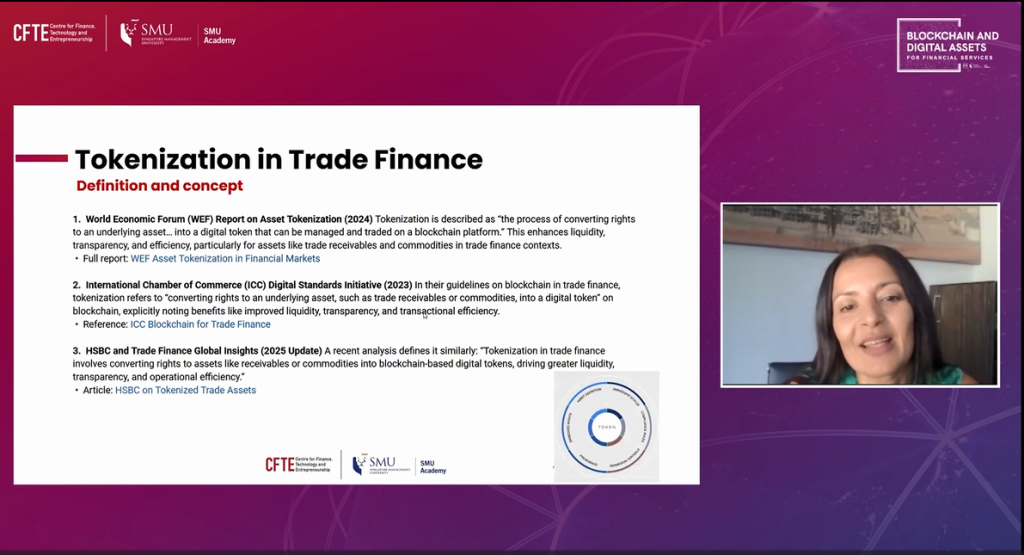

Saloi began by outlining why tokenisation is emerging as a foundational pillar in trade finance. Traditional trade processes are burdened by fragmented systems, inconsistent data, paper-heavy workflows and long settlement cycles. Tokenisation offers a fundamentally different model—one where assets, documents and processes can be digitised, standardised and exchanged with programmable trust.

By converting trade assets such as invoices, letters of credit, guarantees or receivables into tokens, institutions can benefit from:

Faster settlement

Improved liquidity

Greater transparency and auditability

Reduced operational risk

Enhanced interoperability across platforms and borders

Tokenisation, Saloi emphasised, is not simply a technology upgrade. It represents a structural shift toward digital-native trade finance.

Why Standards and Interoperability Matter

A central theme in Saloi’s presentation was the critical need for standards. Tokenisation cannot scale in isolation. It requires:

Shared data models

Common identity frameworks

Legal and compliance harmonisation

Industry-wide agreement on asset definitions

Saloi highlighted how emerging frameworks—such as the Digital Standards Initiative (DSI) and those developed by leading industry bodies—are paving the way for unified digital trade ecosystems. Without such standards, tokenisation risks becoming siloed, fragmented and incompatible across markets.

Collaboration as the Engine of Adoption

Tokenisation thrives through collaboration, not competition. Banks, corporates, fintechs, regulators and technology networks must co-design solutions. Saloi’s work at the XDC Network Enterprise Alliance exemplifies this collaborative model, bringing stakeholders together to build shared infrastructure and tackle adoption barriers collectively.

She also emphasised the growing importance of public-private coordination, particularly around regulatory clarity and cross-border legal frameworks.

Becoming Tokenisation-Ready: Skills and Capabilities

Saloi provided a clear blueprint for organisations preparing to embark on tokenisation initiatives. Key skill areas include:

Understanding digital asset frameworks

Navigating compliance and regulatory design

Smart contract literacy

Process redesign and workflow digitisation

Cross-functional collaboration between technology, operations and legal teams

Tokenisation is not an IT project, it is an organisational transformation that requires new digital competencies across the value chain.

Integrating Tokenised Solutions with Legacy Infrastructure

One of the session’s most practical discussions centred on how banks can integrate tokenisation into existing trade finance systems. Saloi highlighted that the most effective strategy is to begin with well-defined, high-value use cases, and then:

Identify assets that benefit most from digitisation

Map the current processes and pain points

Build tokenised modules that integrate via APIs

Adopt a phased rollout that maintains continuity with legacy operations

The goal is not to replace existing infrastructure immediately but to extend it with digital layers that introduce automation and interoperability.

5 Key Learning Outcomes from the Session

1. Tokenisation transforms trade finance by digitising assets end-to-end

It streamlines processes, increases liquidity, accelerates settlement and reduces friction that has long slowed global trade.

2. Standards are essential for scalable adoption

Without alignment on data, identity and legal frameworks, tokenisation remains isolated. Industry-wide standards unlock interoperability and global connectivity.

3. Collaboration drives real-world implementation

Tokenisation succeeds when banks, corporates, regulators and networks work together to redesign trade processes, not when each operates alone.

4. Successful tokenisation requires new digital skills across organisations

Teams must understand blockchain concepts, regulatory expectations, smart contracts and process redesign, not just technology.

5. Integration with legacy systems must be phased and strategic

Institutions should start with clearly defined assets and use cases, then layer tokenisation onto existing infrastructure through modular, API-driven approaches.

As trade finance undergoes rapid digital transformation, tokenisation stands out as a powerful enabler of transparency, speed and global interoperability. Saloi’s session showed that the future of trade will not simply be digitised, it will be standardised, collaborative and token-powered. For institutions looking to stay competitive, now is the moment to build the skills, partnerships and technological foundations needed to thrive in this new era. With growing momentum across industries and governments, the shift toward digital trade finance is no longer a possibility, it is already underway.