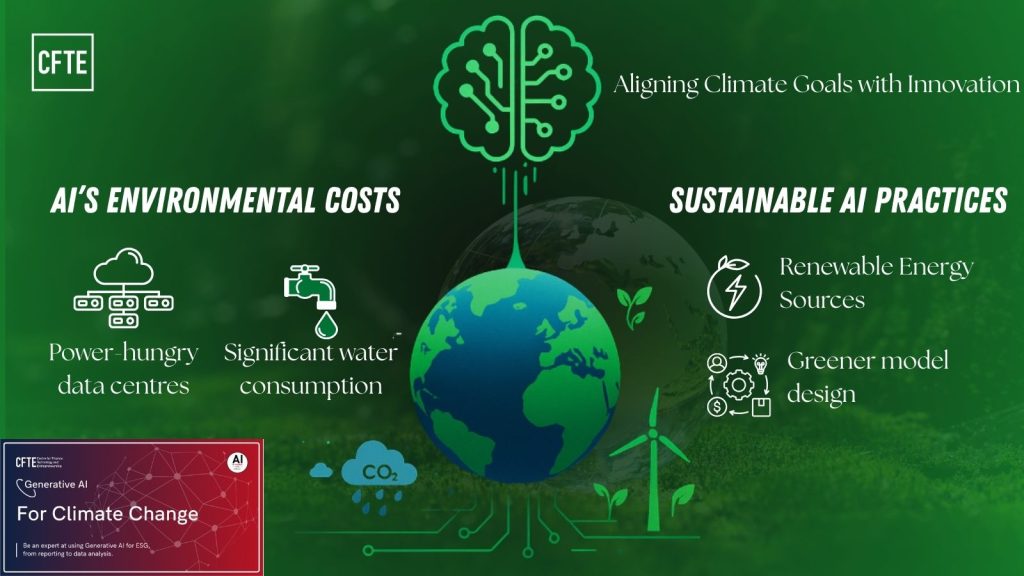

The Environmental Impact of AI

Generative AI requires significant computational resources. The costs aren’t just financial — they’re environmental.

- Energy: Data centres consumed 240–340 TWh in 2022 — 1.3% of global electricity (Wikipedia).

- Emissions: Training GPT-3 produced an estimated 283 tons of CO₂ — equal to 300 NYC–San Francisco flights.

- Water: AI’s projected water withdrawal could hit 6.6 billion m³ by 2027, surpassing Denmark’s annual usage (arXiv).

The Concept of Sustainable AI

Sustainable AI means minimising these impacts while maintaining performance:

- Energy-Efficient Models — Selecting architectures optimised for lower compute needs.

- Prompt Efficiency — Reducing the size and frequency of queries to limit energy use.

- Lifecycle Assessment — Tracking environmental costs from training to deployment.

Why It Matters in Finance

Financial institutions that adopt AI for ESG must ensure that the AI itself aligns with sustainability values. Using energy-inefficient AI undercuts climate commitments and risks reputational damage.

Practical Steps for ESG Leaders

- Integrate sustainability metrics into AI vendor assessments.

- Prioritise cloud providers with renewable energy commitments.

- Include AI environmental impact in ESG disclosures.

Learning to Implement Sustainable AI

The Generative AI for Climate Change in Financial Services course includes modules on sustainable AI adoption, so you can innovate without compromising your climate goals.

💡 Limited Offer:

Enrol ClimateChangeLaunched2025 to save 20%.

👉 [Join the Cohort and Lead Responsibly]